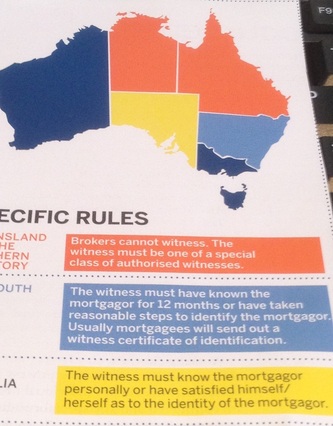

Queensland and the Northern Territory: Brokers cannot witness. The witness must be one of a special class of authorised witnesses.

New South Wales: The witness must have known the mortgagor for 12 months or have taken reasonable steps to identify the mortgagor. Usually mortgagees will send out a witness certificate of identification.

South Australia....... The witness must know the mortgagor personally or have satisfied himself/herself as to the identity of the mortgagor.

Taken from Mortgage & Finance Brief April/May 2013

RSS Feed

RSS Feed