Since the combined capital city housing market began its current growth phase in June 2012 values have increased significantly in Sydney (31.2%), with growth more moderate in Melbourne (17.6%), Darwin (17.5%) and Perth (15.5%) and much slower elsewhere. Combined capital city home values have increased by 8.5% over the 12 months to November 2014 and by 7.0% over the first 11 months of 2014. The annual rate of home value growth peaked in April 2014 at 11.5% across the combined capitals, slowing to 8.5% in November. This trend has been reflected across all capital cities except for Hobart.

Core Logic RP Data anticipates that the rate of capital growth, particularly in Sydney and Melbourne will continue to moderate over the coming year. logic anticipates that values will continue to rise until such time that interest rates increase.

Households

Labour force data for January 2014 recorded the national unemployment rate at 6.0% which was the highest national unemployment rate since July 2003. In November 2014 it was steady at 6.20%.

Further to this, household income growth, consumer and business confidences are all low off the back of the mining sector slow down.

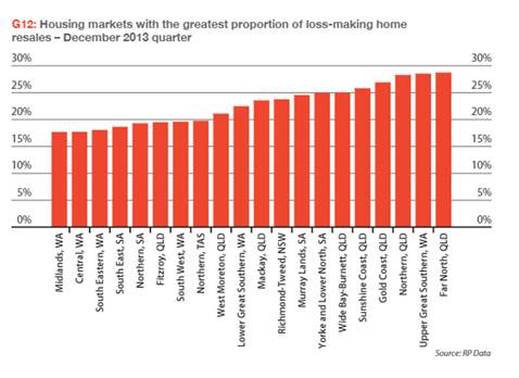

Loss making sales and Regional areas

An interesting by product of recent hikes in property values in major cities is hypothesis that other markets will improve as investors and those priced out of the expensive markets start to look for alternatives. Discounting in regional areas is lessening.

Over 12 months to January 2014, the most expensive 25 per cent of capital city suburbs recorded the greatest increase in home values, while the most affordable 25 per cent of suburbs recorded the lowest rate of value growth.

Despite realised losses on residential property declining, across the country homes that have been owned for between three and five years were most likely to experience a loss. Regional markets continue to be the most likely areas to record loss making sales.

Loss Making Home resales for the Dec 2013 QTR

RSS Feed

RSS Feed