According to the Australian Broker Issue 10.07... An Australian man is currently awaiting trial in the US for a rather bizarre bank robbery. The 39-year-old Melbourne native stole US$140,000 from a bank in Jackson Hole, Wyoming, after presenting the teller with a note that threatened to blow the building up with "four military-grade explosives". When the man was apprehended, he had already given $124,000 of the haul to homeless people and charities across the American West. Perhaps appropriately, the man is a former self-help author!

0 Comments

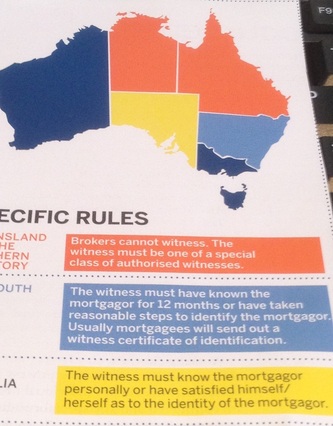

Cristian is 19 years of age, is unmarried and does not have children. He lives with his aunt and uncle in the city of Guaranda in the province of Bolívar. He is a member of the solidarity group "Los Pinos" which is comprised of 14 members from the same community. They work in agriculture planting all types of grains. He sells grains and raises cattle and pigs. He is requesting a loan to buy fertilizers, herbicides, urea, and seeds. With the help of the loan he will be able to buy the agricultural supplies he needs. He does his buying and selling in the city of Guaranda. He also sells outside of the province of Bolívar. His dream is to improve the business, to improve himself and to have a stable life. The challenges that he faces include the economy and competition. In his free time he likes to enjoy carnival celebrations. Wilson Financial has assisted Cristian with microfinance and you can too, follow his funding here...  Many documents require a person to witness the signature of one or more parties. In most cases, there are no special qualifications required to act as a witness other than to be 18 years of age or olderm or a party to the loan. Queensland and the Northern Territory: Brokers cannot witness. The witness must be one of a special class of authorised witnesses. New South Wales: The witness must have known the mortgagor for 12 months or have taken reasonable steps to identify the mortgagor. Usually mortgagees will send out a witness certificate of identification. South Australia....... The witness must know the mortgagor personally or have satisfied himself/herself as to the identity of the mortgagor. Taken from Mortgage & Finance Brief April/May 2013  Salary Sacrifice can be a tax effective way to save for retirement. If you earn over $35,000 your marginal tax rate is higher than 15%, therefore you can benefit from salary sacrificing your salary into superannuation. All Australians under age 50 can contribute up to $25,000 and receive a full tax deduction to their business if self employed. If you are 55 and still working there are some positive tax advantages that may be available to you today. Recent changes to superannuation legislation allow you to boost your retirement savings or increase your income right now. You are eligible to receive a “Transition to Retirement” pension, up to 10% of you Super balance. This income receives a tax credit of 15% and will be taxed at your marginal tax rate, minimising your current tax liability. This will free up income to really bump up your salary sacrificing strategy. If you are an Australian, over 60 and still working your “Transition to Retirement” pension is tax-free. Well technically, it is taxed at 15%, however you still get the tax credit of 15%, making your “Transition to Retirement” pension totally tax free after the age of 60, and you can keep working and contributing to super, right up to age 75, if you choose to stay at work. Now is the perfect time to review your superannuation and put some thought into developing and implementing a retirement plan. The first step is to review your current position. Check your statements to ensure your employer is making all required contributions and that they are being deposited into the correct fund. It’s never too early to plan for your future. Please confirm all of your plans with your accountant, our articles are no substitute for property financial advice and should not be relied upon as tax laws can change rapidly. Pay Down Debt

Your tax refund is a great opportunity to get ahead. Allocate what you can now to pay down your debt, and you’ll save each month with lower payments. The average credit card charges are greater than15% interest. Investing $500 now to pay down your debt can save you over $1,000 over 5 years. Saving Towards A Goal Use your refund to catch up or get ahead on your savings plan. If you don’t have a long-term savings goal, start one today! Don’t be surprised the next time a large bill arrives, set some goals to save and cover these large but predictable expenses. Take Your Business To The Next Level Have you been looking for seed money to take your business to the next level? Do you have a venture that you want to start? You can use your refund to get you moving in the right direction. It’s a great opportunity to turn your refund into income for years to come, and get a few more small business tax deductions next year too. Refinance Your Mortgage Mortgage rates are at the lowest levels they have ever been. Refinancing your mortgage will involve some costs. Use your refund to cover these additional fees and you could save thousands of dollars each year on mortgage interest. Make Home Improvements If you’re satisfied with your current mortgage, take a look around your home. Do you need a new roof? Is your kitchen outdated? Could new energy-efficient appliances save you money on utility bills? Home improvement projects can immediately increase the value of your property and make your home more comfortable at the same time. Didn't get a tax refund? Put some monthly savings measures in place for this financial year so that you're not stung at the end of the year! |

AuthorLiz Wilson has been working in finance for nineteen years now. She regularly blogs on industry topics and here you will find over a hundred personally written blog topics and case studies... Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed