Let’s talk about two fictional characters that could represent clients of ours at Wilson Financial. Any resemblance to actual clients of Wilson Financial is purely coincidental...

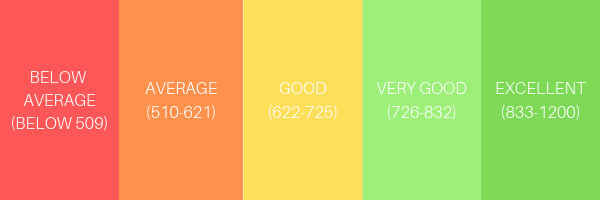

Bobby’s credit score had an unpaid council rates notice, which led to a court judgement. He had no idea as he had moved home and believe it or not, councils move very FAST when it comes to recovering debt. They have even been known to use debt collectors. Further, Bobby had made yearly enquiries for credit cards, Zip-pay, and personal loans. His score was below average as a result at 495.

Alicia’s, a different applicant, had a credit score of 1043, with very few enquiries, no defaults, she presented an excellent track record of paying all current debts.

Which do you think the lenders prefer to see?

You see, each credit score comes with a ‘likelihood of default’ in the next 12 months and Bobby’s was over 8%. Those are NOT good odds. For lenders, bad credit clients are expensive, and do not return on the investment if they need to foreclose. Lenders in Australia have just come out the other side of a royal commission too, so are very risk averse. Even the Reserve Bank Governor has been touting that lenders should take more risk. However, credit scores are definitely making things hard for some Aussies like Bobby.

Now lets talk about Bobby and Alicia applying for what we call "High LVR Lending" also known as low deposit finance for instance. In Alicia's case her credit score will be instrumental in shepherding her through, but for a 95% lend, it will be very hard for Bobby to obtain approval solution until he seeks credit repair and pays his council bills and does some work to improve his score.

Did you know, that you have the right to access your credit score and credit report for free.

Now we STRONGLY recommend accessing only these three company’s for your report:

• Equifax

• CheckYourCredit (illion)

• Experian

Since different agencies can hold different information, you may have a credit report with more than one agency.

We do not recommend other ‘free credit score’ websites online and in our experience Equifax is the most commonly used by banks. Sometimes we are quoted scores from free websites that have no resemblance to the score we obtain from Equifax on the report.

You can pay on Equifax’s website or you can get the free version which is a lot slower process via this link https://www.mycreditfile.com.au/products/equifax-credit-report-formerly-known-my-credit-file

Applicants of Wilson Financial can request a copy of their credit file also.

How did they work out a credit score??

Well Bobby & Alicia had wildy different credit scores so here is what they tell us matters

• How much money you’ve borrowed

• How many credit applications you’ve made

• If you pay on time

• Defaults/Bankruptcies/Court Judgements will lower your score

In Bobby’s case, he had a lot of credit enquiries, and a court judgement which injured his score. It's not forever though, it can be rebuilt and is constantly being updated.

What will be in your report?

Your personal data such as;

• your full name (married names/other changes)

• date of birth

• Your current and prior address

• Your driver's licence number

• Credit products

• Repayment history

• Defaults on utility bills, credit cards and loans

• Credit applications

• Bankruptcy and debt agreements

• Credit report requests

Fixing mistakes in your credit report

If anything is wrong you can ring Equifax or Illion to fix it. We have seen twins, or duplications of peoples names wearing the same credit data. In the case of the twins, they obviously had different names, but the data went on to the wrong twins account (suspicious of course, sibling rivalry?!). Regardless, it’s important to check your file for debt enquiries that are not yours. Identity theft does happen.

In closing

Educating yourself about your credit score is important. If you're unsure, get your credit file first and start there. A frank discussion with a licenced credit advisor at Wilson Financial will open your eyes. We have worked with "Bobby's" plenty of times to assist them rebuild their scores. It does take time, but without knowing where to start, rebuilding is hard. We have had had great success with credit repair company's and can recommend them where needed too. The most important things to consider though are

• Pay all your bills and finance facilities on time EVERY time, as missed payments are now recorded

• Be careful with utilities when you move homes, ensure you closed the final account, or updated your address

• Do not make unnecessary enquiries, try to limit the frequency of your credit enquiries to once a year or less

• Check your credit file every couple of years to ensure the data is accurate

As always, we are here to help with any questions, just call or email the team!

RSS Feed

RSS Feed