Those two words that provide the magical gateway to many a home loan approval; Genuine Savings. What it means, is that the bank wants to know that you have the capacity to save. This means keeping money saved in an account for three months or more. Do this, and the bank will deem you to be a lower risk client. Genuine Savings are important for:

- People without equity in another property

- Low deposit home loans where the borrower is putting in the minimal 5 - 10% deposit.

"Well that’s fair enough really! I can do that!' Lockie replied. We laughed, sitting him back in the seat.

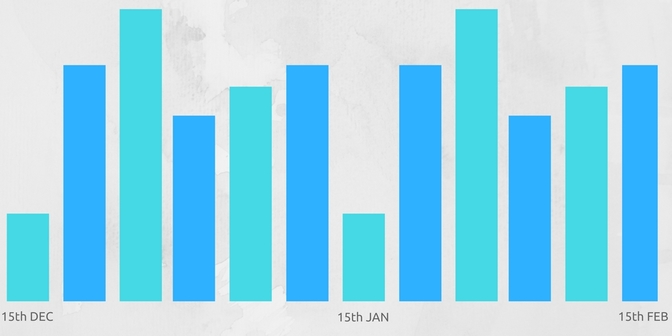

"Genuine Savings can't be choppy. What that means, is that you can't put $2000 in, then a short time later, take $2000 out. $5000 in, and then $3000 out…that sort of thing. Sure, a lot may be going in, but a lot is also going out. Genuine Savings looks more like steady growth in the total amount, through repeated deposits only."

A lightbulb went off for Lockie "Oh ok, so I really should have a separate account for this shouldn't I?" he said.

"Yes, it can't look like slowly saving $500 per week over a few months, and then at the last minute, dump in $10,000 from selling an asset or a sudden windfall. The windfall portion won't be considered 'genuine'!"

"But…" he trailed off, a bit exasperated. "What about the savings I already have? It's taken me a fair while to save it up, but I did get wiped out when I bought a car a month ago. Don't tell me I have to start all over again!?" He slumped, his dreams of soon owning a home threatened.

"It's ok, since you started saving after the car purchase, will count as one months genuine savings, so you just have two more to go" we reassured him.

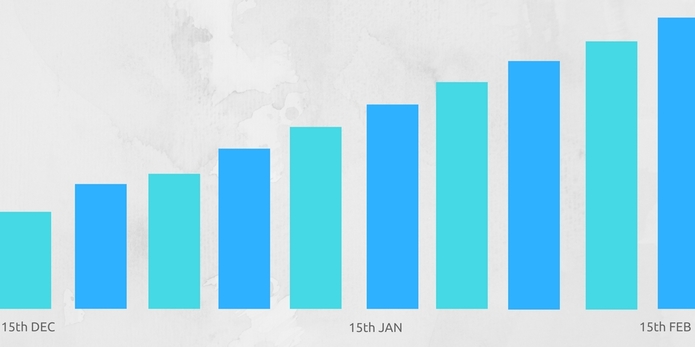

Below is a perfect example of how genuine savings should look but please note, plateaus are also ok.

RSS Feed

RSS Feed